Federal Capital Stock Tax: (Revenue Act of September 8, 1916) and Treasury Department Regulations No. 38, Revised 1918... : Amazon.com.tr: Kitap

Regulations 64 relating to the capital stock tax: under the Revenue Act of 1921 : United States. Internal Revenue Service., .: Amazon.com.tr: Kitap

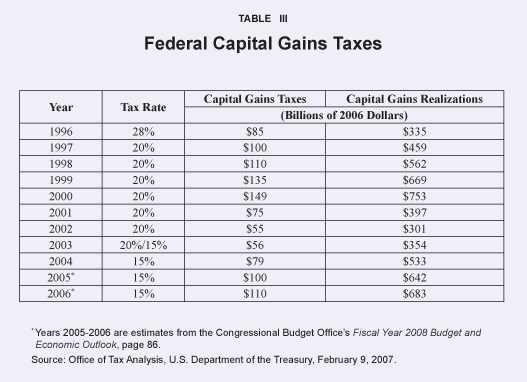

The Tax Break-Down: Preferential Rates on Capital Gains | Committee for a Responsible Federal Budget

Regulations 64 relating to the capital stock tax: under the Revenue Act of 1921 : United States. Internal Revenue Service., .: Amazon.com.tr: Kitap

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)